The data and market information presented in this report have been extracted from publicly available listings, trade offers, and analytical materials published on the Global Trade Metal Portal and the British Scrap Metal Portal.

These platforms are international online marketplaces dedicated to metal, steel, and scrap trading, providing information support to buyers and sellers worldwide. The reported prices reflect observed market indications derived from supplier and buyer quotations and do not represent binding offers or concluded transactions.

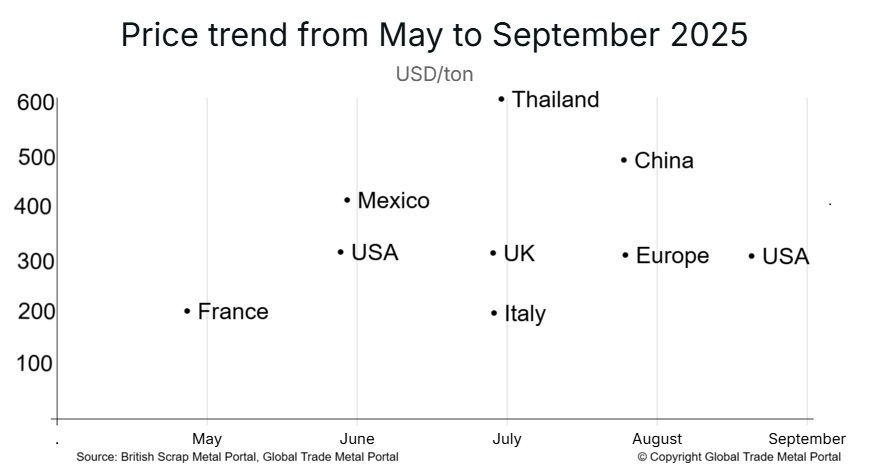

This report covers market price trends for used rail scrap (mainly R50/R65 type) and HMS (80/20) for the period from May to September 2025. Price movements were influenced by regional demand fluctuations, especially strong interest from Asian markets. Variations in rail quality, lot size, and logistics arrangements contributed to differences in observed prices.

Here is a summary of observed prices over six months across key countries in Europe, Asia, and North America, including the USA, Mexico, Thailand, Vietnam, the United Kingdom, Italy, and France.

Demand from Asia is evident as China’s September listing (around 406 USD per ton) indicates that Asian markets remain willing to pay a premium for used rails.

The impact of quality and specifications is illustrated by the Thailand offer at around USD 580 per ton, as reported by Trade Metal Portal. This price reflects a premium specification with over 80% iron content and shows that higher-quality rail scrap attracts significantly stronger bids.

Regional differences and logistics costs explain why the quoted prices in Europe and the USA are lower (around USD 180 to 290 per ton). This suggests excess local supply, weaker demand, or higher costs related to transportation, handling, and disposal.

When major railway maintenance cycles lead to higher availability of used rails, increased supply may exert downward pressure on prices in certain regions. Conversely, when mills operate at high feeding levels, demand for scrap rails may rise and push bid levels upward.

Some offers listed on https://trade-metal.com/used-rail-s8262.html Global Trade Metal Portal were quoted on a CIF/CFR basis into Asia, resulting in higher indicated prices, while others were listed as ex-works or FOB, which appear lower. In addition, certain quotes were provided per meter instead of per ton, making straightforward price comparison more difficult.

The wide price spread suggests that the used-rails market is not yet tightly indexed, as individual lots differ notably in terms of specification, condition, quantity, and delivery terms.

Prices for used rails are influenced not only by market conditions but also by the technical characteristics of the metal. Buyers pay close attention to condition, cleanliness, length, and consistency of lots, as these factors directly impact processing costs and acceptance risks.

These specification factors directly affect price: better chemistry, clean condition, longer cut length, and consistent weight per meter reduce buyer risk and processing cost and therefore command higher prices.

Offers quoted in USD per ton may mix different incoterms, which can obscure actual cost differences related to shipping, insurance, and port handling.

Some entries with very low prices (e.g. around 180 USD per ton in France) may reflect lower specifications, damaged lots, heavier cut lengths, or temporary local oversupply.

Quality or specification mismatches can lead to lot rejection and additional costs. Buyers should always verify certificates and inspection records.

Logistics costs, especially differences between containerized and bulk shipments, unloading fees, and local taxes, vary significantly by region and may compress margins.

For the next few months (late 2025 heading into 2026), used rail prices are expected to remain supported by Asian import demand. As a result, CIF prices into Asia may remain in the range of approximately 370–430 USD per ton, provided that quality specifications are met.

In Europe and North America, where supply conditions may be looser and buyer activity less aggressive, prices for standard R50/R65 grade used rails are expected to remain in the 200–300 USD per ton range under FOB or ex-works terms.

Overall price conditions are expected to remain moderately stable, with Asian markets maintaining the upper price band, while European and North American prices may experience slight downward pressure if local supply increases or quality-related issues arise.

Downloadable copy: Used Rails Prices (May–October 2025)